This blog post is in response to a comment I received about my reposting of "Tax the Rich!", from the March 11, 2011 edition of the Madison, Wisconsin newspaper, The Capital Times:

First of all, let's address what is not fair. It is not fair that Americans working full-time, minimum-wage jobs are living in poverty. The current federal minimum wage, unchanged since July of 2009, is $7.25 per hour. Figuring a forty-hour work week, that works out to $15,080 per year. The current poverty level for a family of four, as defined by the government, is $22,350 in annual income. In single-parent households, where the single parent works full time, or in households with children too young to attend school, where one parent must stay home to provide childcare while the other works full time, the shortfall is $7270, almost a third less than the annual poverty level income.

Obviously, there are families out there making these situations work somehow, and there are individuals working minimum-wage jobs who live with their parents or with roommates to make ends meet, which leads us to one of the biggest problems of the working poor: housing. According to the U.S. Census Bureau, "In 2007, the median monthly housing cost (rent, utilities, and garbage and trash collection) for renter occupied homes was $755." This is 40.54 percent of the annual poverty level income and leaves just $1107.50 per month for all other expenses.

Remember, we are working with gross income figures here, not after-tax figures. It has become popular in conservative politics to point out that about fifty percent of Americans paid no taxes at all last year. This incomplete truth elicits indignation from those who imagine that others are not paying their fair share, but the whole truth is that many of those fifty percent do not make enough money to even qualify to pay income taxes. They may have taxes deducted from their paychecks, but they'll get the money back when they file their 1040EZ forms with the IRS.

Some believe the current progressive income tax system is unfair and that it should be replaced with a flat tax of anywhere from a 10 percent "tithing" to as much as 35 percent. Imagine that your minimum-wage annual income was reduced by $2235 to $7822 for income taxes. Try reworking the housing and expense figures above with these flat-tax amounts subtracted. Now imagine trying to survive on what is left. Is it fair?

Fairness depends on how you think about things. I know people who believe in their hearts that everyone gets what they deserve, that everyone is the sum of their life's decisions. My beliefs are not so black and white. People do not deserve to be poor any more than they deserve to be rich. Life simply works out better for some than for others. And some seem to have forgotten that we are all in this together.

What is fair? A living wage, for starters. The minimum wage needs to be raised to a level that allows all workers to meet their basic material needs, not to live with the fear that they are just an accident or a health crisis away from bankruptcy and homelessness. If this means that the prices of the goods produced by minimum-wage workers will go up, then so be it. I started working when the minimum wage was $3.25 per hour, $4.00 per hour less than it is now, and we have managed to absorb the difference. We'll do it again. And there's a side benefit: If the minimum wage is raised high enough, then the working poor can become tax payers, which benefits their self-esteem and our national budget.

The income tax system? It needs to be kept progressive, but the rates need to accelerate much more quickly than they do now, to at least the levels where they were before the Bush tax cuts, if not much more. "Trickle down" economics has not accomplished anything but to make the rich richer and the poor poorer. The rich do not spend their tax savings to benefit the broad consumer economy; they put them into investments that benefit only the few.

I have owned small businesses that employed as many as four people at a time. I know from experience that tax increases do not kill jobs. Lack of demand is what kills jobs. No customers, no need for employees. The reason our unemployment rate is stuck above nine percent is because a large percentage of the people have no money to spend. Benefiting the few at the expense of the many is selfish and short sighted. We know how to fix the economy. We just need to level the playing field, because we all deserve at least a chance at a decent life. That would be fair.

This blog is an account of the pursuit of a dream, to sail around the world. It is named after the sailboat that will fulfill that dream one day, Whispering Jesse. If you share the dream, please join me and we'll take the journey together.

For Charlie and Scout

For Charlie and Scout

About Me

- John Lichty

- Savannah,

Georgia, USA

"Go confidently in the direction of your dreams. Live the life you have imagined." --Henry David Thoreau

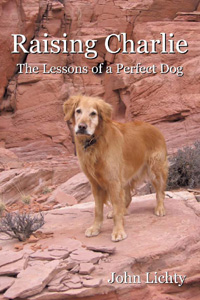

Raising Charlie: The Lessons of a Perfect Dog by John Lichty

Raising Charlie: The Lessons of a Perfect Dog by John Lichty

Blog Archive

Followers

Recommended Links

- ATN Sailing Equipment

- ActiveCaptain

- BoatU.S.

- Coconut Grove Sailing Club

- Doyle Sails - Fort Lauderdale

- El Milagro Marina

- John Kretschmer Sailing

- John Vigor's Blog

- Leap Notes

- Noonsite.com

- Notes From Paradise

- Pam Wall, Cruising Consultant

- Practical Sailor

- Project Bluesphere

- Sail Makai

- So Many Beaches

- Windfinder

Monday, August 15, 2011

Subscribe to:

Post Comments (Atom)

1 comment:

Love to look at sailing blogs and enjoy yours. Have to comment that the min wage should be set at a level where people are willing to hire 15 and 16yr olds at that wage. I owned 5 ice cream shops in my 20s- the govt rose the min wage to 7.25. Most of my 100 employees made over min wage but many were around 6.50. The .75 cent increase cost me 70k a year and made my businesses unviable for sale bc the net went down by over half. Don't mess with entry level employees being able to get work and I don't know anyone that's above 18 and applies themselves that can't get a job well above min wage.

Post a Comment