Last week, a friend emailed me the following article, which appeared in Madison, Wisconsin's newspaper, The Capital Times. I had been thinking of writing about the imminent death of America's middle class, but this article sums it up much better than I ever could:

The crisis is our unwillingness to make rich pay their share

by John Hallinan

U.S. corporations are sitting on $2 trillion in cash -- trillion, not billion. The same people who shipped millions of jobs overseas, caused the financial crisis, and pay themselves multimillion-dollar bonuses every year are now sitting on a mountain of cash. Yet both state and local governments feel the need to give them more tax cuts. To what end? So they can create more profits and sit on bigger piles of cash, so they can play monopoly as they buy each other out, or so they can give themselves even bigger bonuses? There is no indication that they are interested in doing anything to spur the economy.

In December we heard the Republicans tell us that people making over $250,000 per year couldn’t afford a 4 percent tax increase, and it would be terrible for the economy to increase their taxes. Thirty years ago they were paying 70 percent in taxes. Now they pay half that, but a 4 percent increase is just too much to bear.

Now we are told that state workers making $40,000 to $60,000 per year are stealing the state blind. The same workers who for the last two years have taken over a 3 percent pay cut in the form of furloughs are now told they haven’t sacrificed enough. Now they must forfeit 7 percent or more of their pay, and give up their right to negotiate their future. What is appalling is the state workers were willing to give up the money to help out the state. All they asked was to keep their right to negotiate. Yet the wealthiest in our country aren’t willing to give up anything to help our country out of the financial mess they created.

In 1980 Ronald Reagan told the biggest lie ever perpetuated on the American public. He condemned Jimmy Carter for running a $40 billion deficit, and then told everyone he could cut taxes and balance the budget. Voodoo economics -- that’s what George H.W. Bush called Reagan’s economic plan. He was right, and by the mid ’80s the budget deficit had ballooned to over $200 billion.

Of course it was the rich who walked away with virtually all of the Reagan tax cuts. During the last 25 years the Republicans have doubled down over and over again, giving more and more tax cuts to the rich. While the rich have gotten incredibly wealthy, the poor have gotten poorer. It is a reverse Robin Hood economy where we take from the poor and give to the rich. It has been the greatest transfer of wealth in the history of our country -- the 400 richest have more than the 155 million poorest.

Ballooning government deficits weren’t a problem when Republicans were in the White House, but with a Democratic president, it is suddenly a crisis. The recession we’ve been living through proves the fallacy of Milton Friedman, Reaganomics, Ayn Rand, Alan Greenspan and the rest who told us that markets are self-correcting and regulation is bad. Banking regulations kept this country out of serious recession for 70 years, but once the regulations were repealed it took only a decade to bring the world’s economy to its knees. Yet Republicans refuse to acknowledge how wrong they were as they continue to try to gut government regulations.

Every time a politician tells you he wants to make the government more business friendly, what he’s really telling you is that he wants to increase taxes on your children and grandchildren. Every environmental law that is weakened will mean a cleanup to be paid for by future generations. Every bad business practice that is endured will be funded by taxpayers having to clean up the mess at some later date.

Now we are told that everyone must sacrifice to bring state and federal government budgets in line. But somehow the sacrifices once again all fall on those at the bottom of the economic ladder. Once again businesses are given tax cuts, money is found to increase spending on roads, but education, health care and help for the poorest in our society are cut.

There isn’t a financial crisis at either the state or the federal government. The crisis is our unwillingness to ask those who have gained the most from our society to pay a fair and equitable share from the wealth this society has allowed them to accumulate. It is the honest, Christian, and patriotic thing to do.

© 2011 The Capital Times

Published on Friday, March 11, 2011 by The Capital Times, Madison, Wisconsin. John Hallinan is a Stoughton, Wisconsin resident.

This blog is an account of the pursuit of a dream, to sail around the world. It is named after the sailboat that will fulfill that dream one day, Whispering Jesse. If you share the dream, please join me and we'll take the journey together.

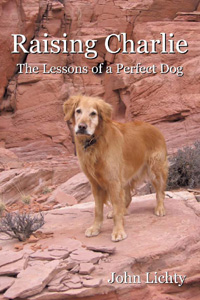

For Charlie and Scout

For Charlie and Scout

About Me

- John Lichty

- Savannah,

Georgia, USA

"Go confidently in the direction of your dreams. Live the life you have imagined." --Henry David Thoreau

Raising Charlie: The Lessons of a Perfect Dog by John Lichty

Raising Charlie: The Lessons of a Perfect Dog by John Lichty

Blog Archive

Followers

Recommended Links

- ATN Sailing Equipment

- ActiveCaptain

- BoatU.S.

- Coconut Grove Sailing Club

- Doyle Sails - Fort Lauderdale

- El Milagro Marina

- John Kretschmer Sailing

- John Vigor's Blog

- Leap Notes

- Noonsite.com

- Notes From Paradise

- Pam Wall, Cruising Consultant

- Practical Sailor

- Project Bluesphere

- Sail Makai

- So Many Beaches

- Windfinder

Saturday, March 19, 2011

Subscribe to:

Post Comments (Atom)

2 comments:

I am amazed by the one dimensional thought process of so many educational elite. Tax the rich does make sense, but so often this argument hinges on the nominal amounts one earns or some corporation has in the bank. The reality is that we DO tax the rich. We have a progressive tax system in which the rich (or those that earn more) pay far greater taxes nominally than those who earn less. If you dig deeper, a flat tax, with out ANY exemptions is what you are arguing for, for example 35% for ALL people. The political parties most opposed to this are the democrats, primarily because this removes their ability to extend tax benefits to their constituents. If we did this, the "rich" would pay fewer taxes and the "poor" would ultimately pay more. I agree with the assessment that corporations should be held to a similar flat tax structure. However, if we dig deeper, we must also realize that the politicians put these structures in place. That is, companies are extended tax breaks in exchange for some other economic benefit, such as jobs or value added tax (VAT) dollars. It is the other side of the argument that is almost always ignored when journalists sensationalize the great atrocities that have fallen upon their readers. Read with care or blindly fall in line with the lemmings.

Thank you for your comments. I am most definitely not arguing for a flat tax. I am arguing for what is fair and just, and 35% for every tax payer is not fair to the working poor. For me, the issue is not just taxes, it's income and what it takes to survive in this country economically. I will address this issue in detail in an upcoming blog post.

Post a Comment